How DuckDuckGo (and Microsoft) benefit from Google’s sprawling advertising business

Smaller search engines are able to monetize their results with Google’s advertiser base to reach searchers on those properties with as few obstacles as possible.

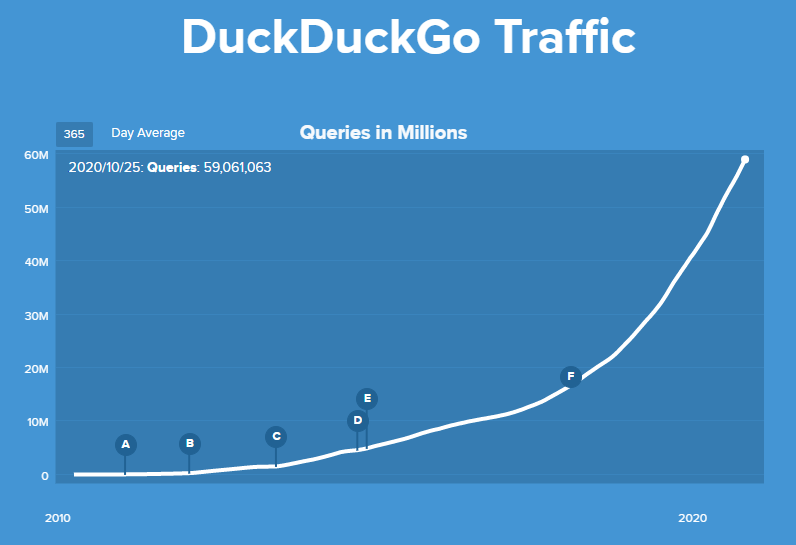

This rise could be evidence that Google’s dominance is not prohibitive to the rise of competitors, and that a search engine focused on user privacy can succeed in building a real business. However, smaller search engines like DuckDuckGo benefit from the expansive network of advertisers bidding on Google search ads. Here’s how.

Smaller engines rely on ease of campaign duplication to pull Google advertisers

The second-largest search business in the US, Microsoft Advertising, is built on query volume coming from Yahoo and Bing as well as other search partners, including DuckDuckGo. Bing and Yahoo account for about 3.5x and 5x as much organic search traffic as DuckDuckGo, respectively, according to Statista.

The benefit to using a platform like Microsoft Advertising to DuckDuckGo is that Microsoft can attract many more advertisers with its aggregate volume than DuckDuckGo could hope to at this stage in its business. This is because, in addition to the cost of actual paid search clicks, there is a cost to managing campaigns on different platforms in the form of additional time and effort to launch those campaigns and optimize them correctly. By joining Microsoft Advertising’s network, then, DuckDuckGo is able to garner ad dollars from advertisers that wouldn’t be able to profitably launch ads on DuckDuckGo if it required entirely separate management.

However, the same is also true of Microsoft Advertising, which leans into its own tools developed specifically with the aim of making it as easy as possible to duplicate Google campaigns to its platforms. To quote Microsoft’s own literature on Google Import:

‘If you’re already using Google Ads, you can save a lot of time by importing your campaigns directly into Microsoft Advertising…The less time you spend managing your ads, the more you can focus on serving your customers.’

No such capability exists when it comes to importing Microsoft Advertising campaigns into Google, because Google, as the dominant search engine, is able to attract the largest pool of advertisers in the US.

Microsoft Advertising knows that, while the aggregate volume of the properties in its network is absolutely meaningful, many businesses would not be as active on its platform if there were significant differences in how campaigns were launched and managed relative to Google. Again, campaign launches and management take time, and if advertisers are able to tap into 90% of the paid search opportunity by focusing on just Google, many would only launch on Google were it not very easy to port those campaigns and settings over to Microsoft Advertising. Microsoft understands this, which is why a tool like Google Import exists.

DuckDuckGo, by way of being a part of the Microsoft Advertising network, also benefits from Microsoft making it as easy as possible for Google advertisers to duplicate campaigns into its platform. Were DuckDuckGo to launch its own platform, it would likely also have to create a similar import tool to either port over campaigns from Microsoft Ads or Google itself in order to maintain the pool of advertisers it has benefitted from in its business so far.

Conclusion

The purpose of this column is not to take sides on the question of searcher privacy or the pros/cons of Google’s dominant search position. It is merely to unpack the economics of how smaller search engines are able to monetize their results, and how that has largely relied on making it easy for Google advertisers to reach searchers on those properties with as few obstacles as possible.

Google itself also ostensibly benefits from this arrangement in a sense that it can point to legitimately viable competitors that are able to make money in search even without Google’s expansive volume. This is potentially even more important to Google now that it faces a DOJ investigation into its search dominance.

For better or worse, Google’s dominant search volume gives it more data to use in producing search results and attract more advertisers to its platform with bigger opportunity. Yahoo itself, now a part of Microsoft Advertising, indirectly acknowledged how powerful that flywheel can be when it decided to reenter a deal with Google in 2015 to power some of its ads that lasted until early 2019.

Whether Google has abused its position to further diminish competition is a more complicated question for another day. For now, it seems clear, to me at least, that other search engines have relied to an extent on Google’s advertiser base to help propel their own advertising businesses. That’s true even of DuckDuckGo.